Asmodee to saddle over $920 million debt as parent company splits in 2025

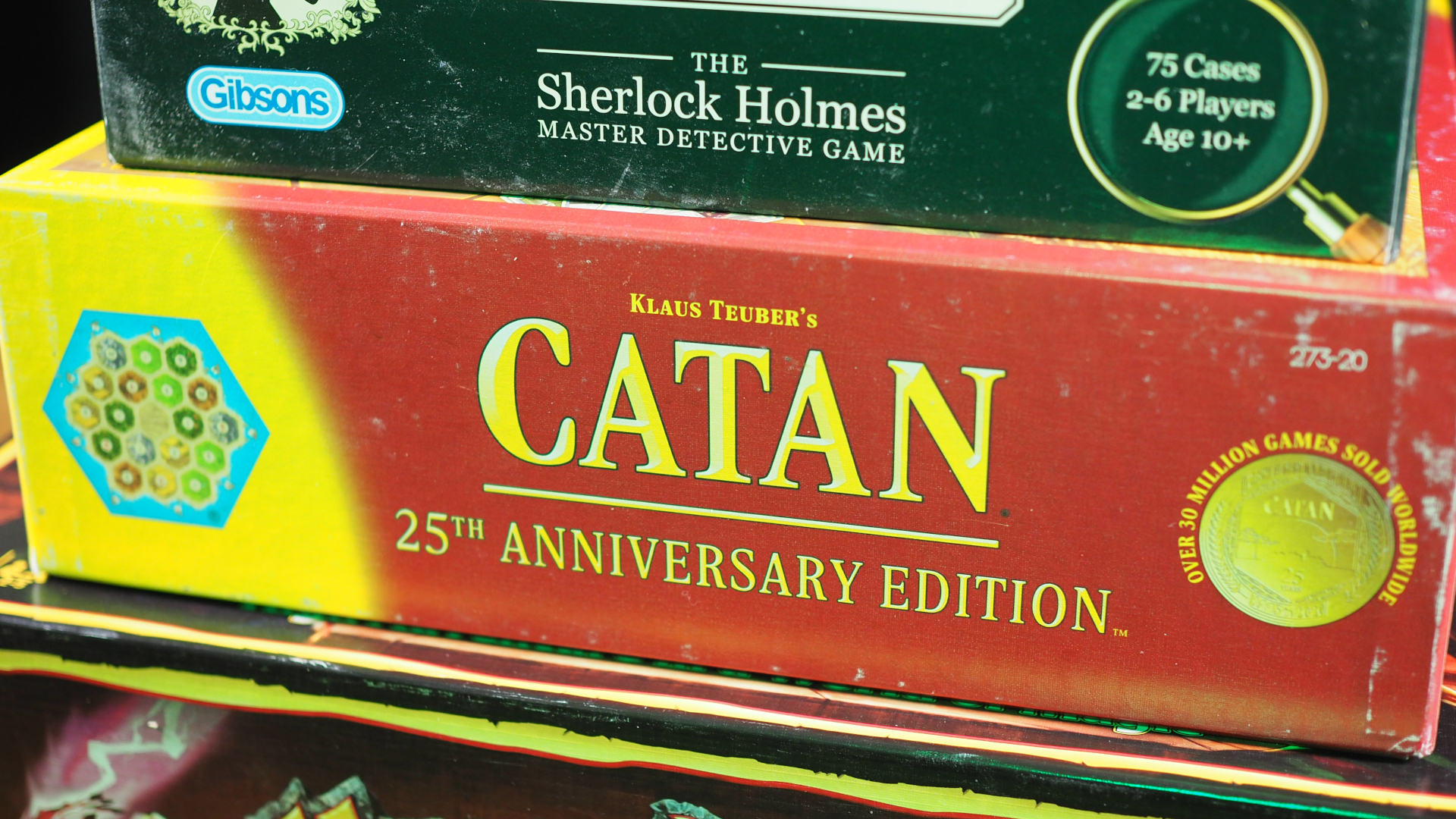

The company behind Catan and Ticket to Ride will take on some of the burden for its sister companies

Embracer Group is all set to split into three separate companies this year, with leading tabletop publisher and distributor Asmodee becoming a separate entity alongside sister companies Middle-earth Enterprises & Friends and Coffee Stain & Friends. As of last week, the Listing Committee of Nasdaq Stockholm has approved Asmodee’s listing application, but along with it comes an incredible debt to shoulder.

Responsible for some of the best board games out there, Asmodee is one of those companies almost synonymous with board games today. Changes to it's parent company are likely to affect the board gaming industry in a big way. In particular, as the original announcement post back in April 2024 notes, Asmodee has arranged to burden a large chunk of debt Embracer Group had incurred from acquiring other companies.

For a little context, Asmodee's sister company Middle-earth Enterprises & Friends is behind a host of popular digital triple A games, as well as owners of The Lord of the Rings and Tomb Raider intellectual properties. Coffee Stain & Friends are the lesser known of the two, dealing in free-to-play games for PC, console and mobile. As of 2023 (the year before the original announcement) Middle-earth Enterprises & Friends' net sales hit an approximate $1.29 billion, while Coffee Stain & Friends was sitting on $997 million-ish, after tax and interest. Asmodee on the other hand, saw sales of around $1.35 billion.

As the marginally more profitable of the three, Asmodee stands to shoulder over $900 million to ease the burden of a much larger debt on the parent company, totaling around $1.5 billion today.

In a recent post on the Embracer Group website, the parent company issued the following statement around the subject:

"Following a careful and thorough review, it is the assessment of the Board of Directors that the current Group structure does not create optimal conditions for future value creation both for Embracer Group’s shareholders and other stakeholders." Therefore the decision to split was made in order to "Continue the transformation of Embracer Group into the future for the benefit of all employees, gamers and shareholders".

Asmodee's own prospectus outlining the changes makes it clear that "The price and value of the securities may go down as well as up and past performance is no guide to future results" in light of the recent changes.

Sign up to the GamesRadar+ Newsletter

Weekly digests, tales from the communities you love, and more

As far as the split was heralded in Embracer's original announcement post, the parent company called it a "transformative step for value creation". The post gives more insight as to Asmodee's role in clearing up some of the outstanding debts for its sister companies, too.

"As part of the Asmodee separation process, Embracer Group has, through Asmodee Group, entered into a new financing agreement amounting to EUR 900 million. The proceeds from the financing are used to repay existing debt and reduce leverage in the remaining Embracer Group".

That's around $928 million of debt in US dollars.

To mimic one of the top commenters on the r/boardgames subreddit: "So they saddled their good performer with the debt to cover for their mistakes before spinning it off onto unsuspecting investors?" It sure looks that way.

The coming months will tell how big of an impact the change will have on Asmodee, and by extension the board game industry as a whole, though Embracer's former COO Matt Karch told Game Developer a while back that Asmodee is in a good position to handle the debt. So, here's hoping.

For more recommendations, why not check out the best classic board games.

Katie is a freelance writer with almost 5 years experience in covering everything from tabletop RPGs, to video games and tech. Besides earning a Game Art and Design degree up to Masters level, she is a designer of board games, board game workshop facilitator, and an avid TTRPG Games Master - not to mention a former Hardware Writer over at PC Gamer.